College is meant to open doors to better opportunities. But for many students and families, the cost makes it feel impossible. Tuition keeps rising, and student debt is piling up. On top of that, hidden costs make college even more expensive. So why has higher education become so unaffordable?

There’s no single reason. Government funding has decreased. Administrative costs have gone up. At the same time, student loans and everyday expenses add to the financial burden.

In this guide, you’ll learn why college costs so much and what’s driving tuition increases. You’ll also discover ways to manage expenses and make college more affordable.

Key Takeaways

- College costs include tuition, housing, meal plans, textbooks, and extra fees.

- Inflation and reduced government funding have driven tuition prices higher.

- Student loans add to the financial burden and can take years to repay.

- Hidden fees like technology and activity charges increase college expenses.

- Planning ahead and exploring financial aid options can make college more affordable.

How Inflation and Economic Factors Drive Up College Tuition Costs

Inflation impacts many aspects of life, and college expenses are no exception. Over the past few decades, tuition has risen faster than the general cost of living. From 2010 to 2023, tuition at public four-year institutions increased by 36.7%.

One major factor is reduced government funding. Public universities once relied heavily on state support, but many states have cut education budgets. As a result, colleges raise tuition to make up for the lost funding. Private schools, which don’t depend on state funding, also increase prices due to inflation, rising demand, and expanding facilities.

Another reason tuition keeps rising is the growing cost of services. Colleges invest in new technology, student support programs, and modern campus amenities to attract students. While these improvements can enhance the student experience, they also drive up costs.

Why Is Higher Education So Expensive?

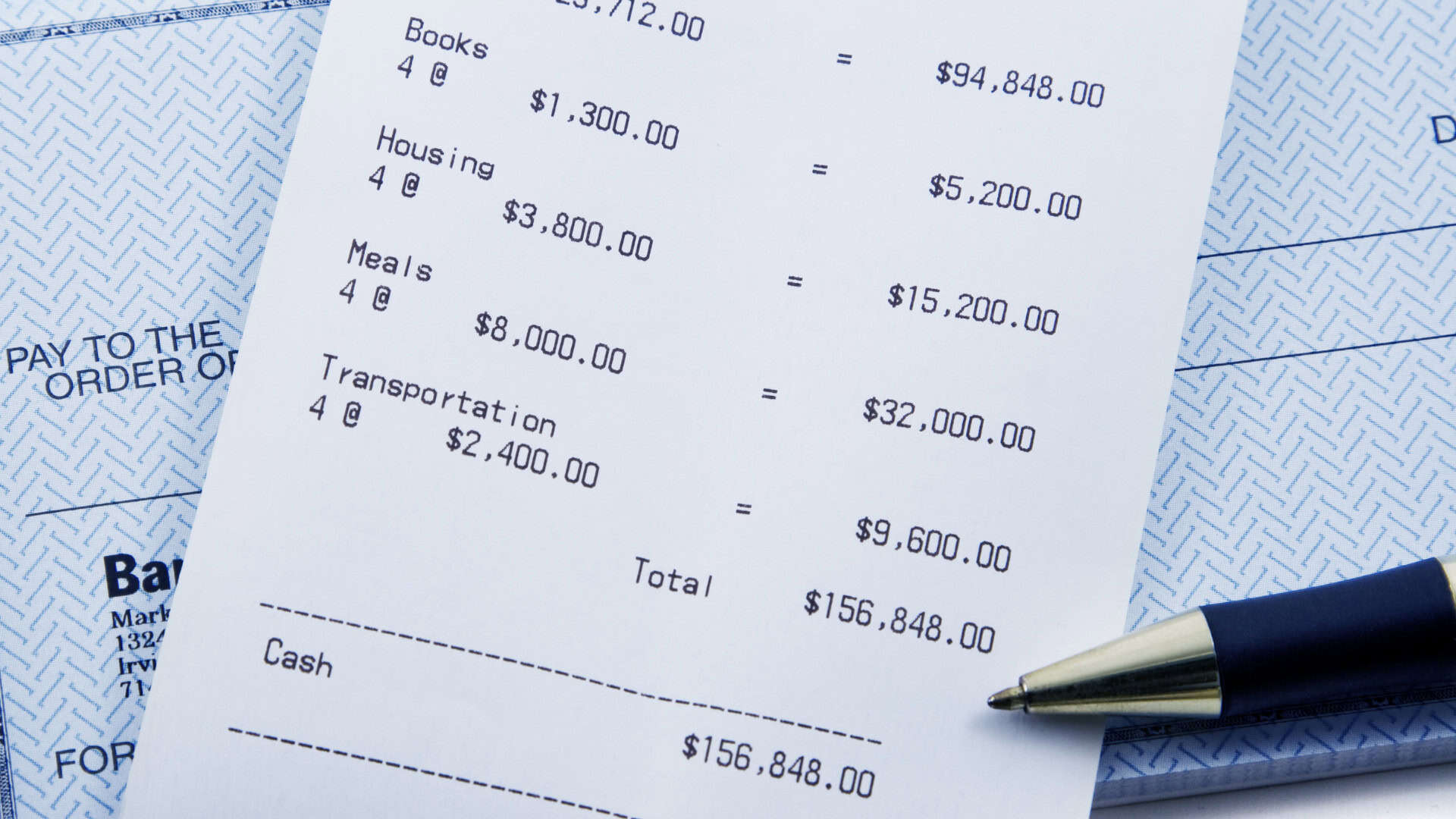

Higher education costs extend far beyond tuition. Expenses like housing, meal plans, campus fees, textbooks, and technology significantly add to the financial burden.

Housing, Meal Plans, and Campus Fees

Living on campus offers convenience but comes at a high price. On average, room and board can add thousands of dollars to your annual expenses. For instance, during the 2023–2024 school year, living on campus (room and board) usually cost about $12,000 to $15,000 per student.

Additionally, mandatory campus fees for services like health centers, recreational facilities, and student organizations can further increase costs. These fees, while supporting valuable services, often catch students by surprise.

Textbooks and Materials

Course materials are another significant expense. The College Board reports that during the 2021–2022 academic year, full-time undergraduates at four-year institutions spent an average of $1,200 on books and supplies.

Purchasing new textbooks directly from the university can lead to increased costs. To manage these expenses, consider buying used textbooks, renting them, or exploring digital versions.

Impact of Technology and Facility Fees on Tuition Bills

Modern campuses invest heavily in technology and facilities to enhance the learning environment. While these advancements benefit students, they also contribute to rising tuition costs.

For example, some colleges charge an environmental services fee to cover sustainability initiatives on campus, like recycling. The cost is usually minimal but adds to the overall expenses. Additionally, technology fees support campus-wide internet access, online course platforms, and computer labs. These fees, though often necessary, increase the overall cost of attendance.

Student Loans and Debt

Overwhelmed by college research?

Let us help save time and find the perfect schools for your family.

Understanding student loans is key to financing your college education. Knowing the difference between federal and private loans is essential. This knowledge helps you manage your debt better. It’s important to understand the interest rates and repayment plans each offer.

Federal vs. Private Loans: Which Is the Better Option?

The government funds federal student loans and typically offers lower interest rates and more flexible repayment options. They don’t require a credit check and provide benefits like income-driven repayment plans and potential loan forgiveness.

Private student loans, offered by banks or other financial institutions, may have higher interest rates and less flexible terms. They often require a credit check and may not offer the same borrower protections as federal loans. It’s generally advisable to exhaust federal loan options before considering private loans.

Interest Rates and Repayment

Federal student loans have fixed interest rates set by Congress, which means the rate remains the same throughout the life of the loan. For example, the interest rate for undergraduate Direct Subsidized Loans is currently 4.99%.

Repayment plans are flexible, with options like income-driven repayment, which adjusts your monthly payment based on your income and family size. Private student loans may offer fixed or variable interest rates, which can change over time.

Repayment terms vary by lender and may not offer the same flexibility as federal loans. It’s important to understand the terms of your loan and choose a repayment plan that fits your financial planning.

Is College Still Worth the Investment?

Higher education is a big financial commitment, and the return on investment depends on various factors, like career prospects, earning potential, and student debt. While a degree can open doors to better job opportunities and higher salaries, not all majors offer the same financial benefits.

Long-Term Financial Benefits of a Degree

A college degree is still one of the best ways to increase your lifetime earning potential. On average, individuals with a bachelor’s degree earn significantly more over their careers than those with only a high school diploma.

The U.S. Bureau of Labor Statistics (BLS) reports that the median weekly earnings for a worker with a bachelor’s degree is about $1,432, compared to $853 for someone with only a high school diploma. Over a lifetime, this difference can add up to hundreds of thousands of dollars.

Beyond higher wages, degree holders are also more likely to have better job security, employer-provided benefits like health care and retirement plans, and access to career growth opportunities. Many professional fields, including business, healthcare, and engineering, require a degree as a basic qualification, making it an essential step toward certain career paths.

Rising student debt has led some to question whether college is still worth it. The key is to weigh the cost of your education against your expected earnings and make strategic choices about where you go to school and what you study.

Do College Graduates Earn More?

In most cases, college graduates consistently earn more than non-graduates. Workers with a bachelor’s degree earn 84% more over their lifetime than those with just a high school diploma. Even when factoring in student loans, many degree holders remain financially ahead.

However, the wage gap varies depending on the field of study. STEM (Science, Technology, Engineering, and Math) and business graduates tend to have higher starting salaries and stronger job prospects compared to those with degrees in liberal arts or social sciences.

It’s also important to note that not all degrees guarantee high salaries right away. Some graduates take time to build their careers and increase their earning potential over time. Choosing a major with strong job demands and taking advantage of internships, networking, and skill development can help boost your income potential.

Does Your Major Matter?

Your major plays a huge role in determining how much you’ll earn after graduation. At the same time, college itself is an investment. Not all degrees offer the same financial return.

According to the National Association of Colleges and Employers (NACE), the highest-paying majors tend to be in engineering, computer science, and business, with starting salaries ranging from $60,000 to $80,000 per year. On the other hand, majors in the arts, humanities, and social sciences often lead to lower-paying careers, with some starting salaries below $40,000 per year.

How Can Students and Families Afford College?

Affording college is a significant concern for many families, but with careful planning and utilization of available resources, it’s possible to manage the costs effectively. Here are some strategies to consider:

- Apply for Federal Financial Aid

Start by completing the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for federal grants, work-study programs, and loans. Many states and colleges also use FAFSA information to award their own aid. Submitting the FAFSA is a crucial step in accessing various forms of financial assistance. - Seek Scholarships and Grants

Explore scholarships and grants offered by colleges, private organizations, and government agencies. Unlike loans, these funds don’t need to be repaid. Utilize scholarship search engines and consult with your school’s financial aid office to find opportunities that match your background and interests. - Consider Work-Study Programs and Part-Time Employment

Participating in a federal work-study program or securing a part-time job can help cover educational expenses. These opportunities not only provide income but also offer valuable work experience. Balancing work and study requires careful time management, but many students successfully manage both. - Utilize Savings and 529 Plans

If you’ve been saving for college, now is the time to use those funds. 529 college savings plans offer tax advantages and can be a valuable resource in covering tuition and other qualified college expenses. Even if you haven’t started saving early, it’s worth exploring these options for future educational needs. - Explore Federal and Private Student Loans

After exhausting grants, scholarships, and personal savings, student loans can help bridge the financial gap. Federal loans often come with lower interest rates and more flexible repayment options compared to private loans. Understanding the terms and borrowing responsibly is essential to minimize future debt. - Consider Community College or In-State Public Universities

Starting at a community college or choosing an in-state public university can significantly reduce tuition costs. Many students complete their general education requirements at a community college and then transfer to a four-year institution, resulting in substantial savings. - Develop a Budget and Manage Expenses

Creating a detailed budget helps track income and expenses, ensuring you live within your means. Consider cost-saving measures like renting textbooks, utilizing public transportation, and limiting discretionary spending. Small adjustments can add up to significant savings over time.

Conclusion

College has become more expensive than ever, leaving many students and families struggling to afford higher education. Rising tuition, hidden fees, student loans, and economic shifts have all contributed to the crisis. While a degree still offers long-term benefits, the financial burden can be overwhelming without careful planning.

But there are ways to manage the cost. Scholarships, grants, financial aid, and smart budgeting can make college more affordable. Exploring alternative education paths, like community colleges or trade schools, can also reduce expenses.

About College Journey

With the cost of college on the rise, making the right choices about your education is more important than ever. That’s where College Journey comes in. Powered by Alice, your AI college counselor, College Journey helps you navigate the complexities of college admissions while keeping your financial future in mind.

From understanding how schools evaluate factors like GPA, test scores, extracurriculars, and essays to getting expert advice on standing out, Alice provides the personalized guidance you need. Whether you’re looking for scholarships, comparing colleges based on affordability, or strategizing your application, Alice is here to make the process easier.

With tools to track your progress, explore financial aid options, and plan for the cost of college, College Journey ensures you stay informed and prepared—without the stress. Best of all, it’s completely free to sign up!

FAQ

Why do private colleges cost more than public colleges?

Private colleges rely on tuition and donations since they don’t receive state funding, making them more expensive. On the other hand, public colleges get government support, which helps lower tuition for in-state students.

How does student loan forgiveness work?

Federal loan forgiveness programs, like Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) forgiveness, cancel remaining student debt after meeting specific conditions, such as working in public service or making payments for a set number of years.

Can attending community college help save money?

Community colleges offer lower tuition and allow students to complete general education requirements before transferring to a four-year school, significantly reducing the total cost of a degree.

Why are college application fees so high?

Application fees cover processing costs, administrative work, and evaluation of applications. Some schools offer fee waivers for students with financial need.

Are online degrees cheaper than traditional college programs?

Often, yes. Online programs typically cost less because they don’t require expenses like housing, meal plans, or campus fees. However, tuition varies by school and program.